Latest News

Buckle up — this week’s slate is a catalyst grid primed to either light a fire under stocks or slam on the brakes.

Via Talk Markets · April 27, 2025

Via Talk Markets · April 27, 2025

You can’t manufacture prosperity in a country that doesn’t manufacture savings.

Via Talk Markets · April 26, 2025

Via Benzinga · April 26, 2025

The U.S. Dollar’s tumble has been capturing the headlines as of late, and we even have magazine covers showcasing its drop.

Via Talk Markets · April 26, 2025

A discussion about how recent market moves are being driven more by reflexive flows and volatility dynamics than true changes in risk expectations.

Via Talk Markets · April 26, 2025

Via Benzinga · April 26, 2025

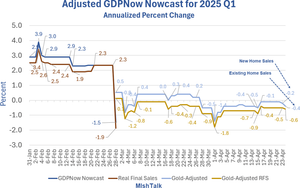

The base nowcast is -0.4 percent down from -0.1 percent on April 17.

Via Talk Markets · April 26, 2025

Mark Clubb: There is undoubtedly too much noise in financial advice today … dressed up as wisdom and too many professionals repeating slogans instead of offering substance…” We agree.

Via Talk Markets · April 26, 2025

These real estate investment trusts (REITs) yield 4% or more and offer double-digit growth in some cases. Buy them, hold them, and reinvest the dividends.

Via The Motley Fool · April 26, 2025

This streaming video giant may have more room to run.

Via The Motley Fool · April 26, 2025

Via The Motley Fool · April 26, 2025

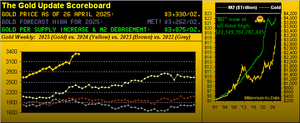

It's not a fluke. Gold has trounced the broader market over the past 25 years.

Via The Motley Fool · April 26, 2025

Estée Lauder is currently considered a high-risk stock. The brand is iconic, but it’s facing real challenges—weak sales in China, a botched acquisition, rising debt, and a stock price that’s dropped over 83% from its peak.

Via Talk Markets · April 26, 2025

Via The Motley Fool · April 26, 2025

Freight delivery company Knight-Swift Transportation (NYSE:KNX) beat Wall Street’s revenue expectations in Q1 CY2025, but sales were flat year on year at $1.82 billion. Its non-GAAP profit of $0.28 per share was 18.4% above analysts’ consensus estimates.

Via StockStory · April 26, 2025

Medical device company ResMed (NYSE:RMD) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 7.9% year on year to $1.29 billion. Its non-GAAP profit of $2.37 per share was in line with analysts’ consensus estimates.

Via StockStory · April 26, 2025

Via Benzinga · April 26, 2025

Via The Motley Fool · April 26, 2025

Pest control company Rollins (NYSE:ROL) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 9.9% year on year to $822.5 million. Its non-GAAP profit of $0.22 per share was in line with analysts’ consensus estimates.

Via StockStory · April 26, 2025

Auto parts and accessories retailer O’Reilly Automotive (NASDAQ:ORLY) missed Wall Street’s revenue expectations in Q1 CY2025 as sales rose 4% year on year to $4.14 billion. The company’s full-year revenue guidance of $17.55 billion at the midpoint came in 0.6% below analysts’ estimates. Its GAAP profit of $9.35 per share was 5.6% below analysts’ consensus estimates.

Via StockStory · April 26, 2025

Equipment rental company United Rentals (NYSE:URI) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 6.7% year on year to $3.72 billion. The company expects the full year’s revenue to be around $15.85 billion, close to analysts’ estimates. Its non-GAAP profit of $8.86 per share was 0.5% above analysts’ consensus estimates.

Via StockStory · April 26, 2025