Latest News

Alphabet's cloud computing segment is soaring, but investors must weigh this momentum against the company's massive capital expenditure plans.

Via The Motley Fool · March 7, 2026

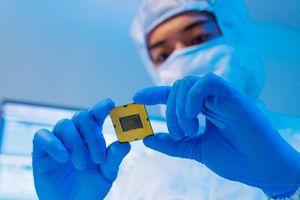

Nvidia has produced tremendous returns and delivered incredible earnings, but a smaller artificial intelligence (AI) stock may produce higher gains in the future.

Via The Motley Fool · March 7, 2026

Chili's is becoming a best-in-class operator.

Via The Motley Fool · March 7, 2026

Via Talk Markets · March 7, 2026

Via Talk Markets · March 7, 2026

The blue chip financial giant has a brighter future than the digital payments leader.

Via The Motley Fool · March 7, 2026

Greg Abel recently issued his first-ever annual letter to shareholders.

Via The Motley Fool · March 7, 2026

With some of the most prominent consumer staples stocks stretched on valuation, Mondelez may be a compelling idea for income and value investors.

Via The Motley Fool · March 7, 2026

Via Talk Markets · March 7, 2026

Buffett continued to sell more stock than he bought in his last quarter as CEO.

Via The Motley Fool · March 7, 2026

Nvidia earned $62.3 billion in data center revenue last quarter.

Via The Motley Fool · March 7, 2026

The AI-driven insurer still has a bright future.

Via The Motley Fool · March 7, 2026

Wall Street's rally may soon run out of steam.

Via The Motley Fool · March 7, 2026

Micron is in a cyclical industry -- and that's an important consideration.

Via The Motley Fool · March 7, 2026

A traffic decline in a model with no room to absorb it.

Via The Motley Fool · March 7, 2026

Via Talk Markets · March 7, 2026

Rapid income growth and an attractive forward P/E ratio could lead to more investors buying.

Via The Motley Fool · March 7, 2026

Chewy stock offers investors an opportunity right now.

Via The Motley Fool · March 7, 2026

What if a bond fund could earn 10% or more per year? It's possible -- but there are downsides.

Via The Motley Fool · March 7, 2026

The intriguing thing is that the same company offers both.

Via The Motley Fool · March 7, 2026

Accelerating growth and stellar guidance haven't been enough to help the stock in 2026.

Via The Motley Fool · March 7, 2026